Understanding the Global Money Transfer Services Market: A Comprehensive Analysis

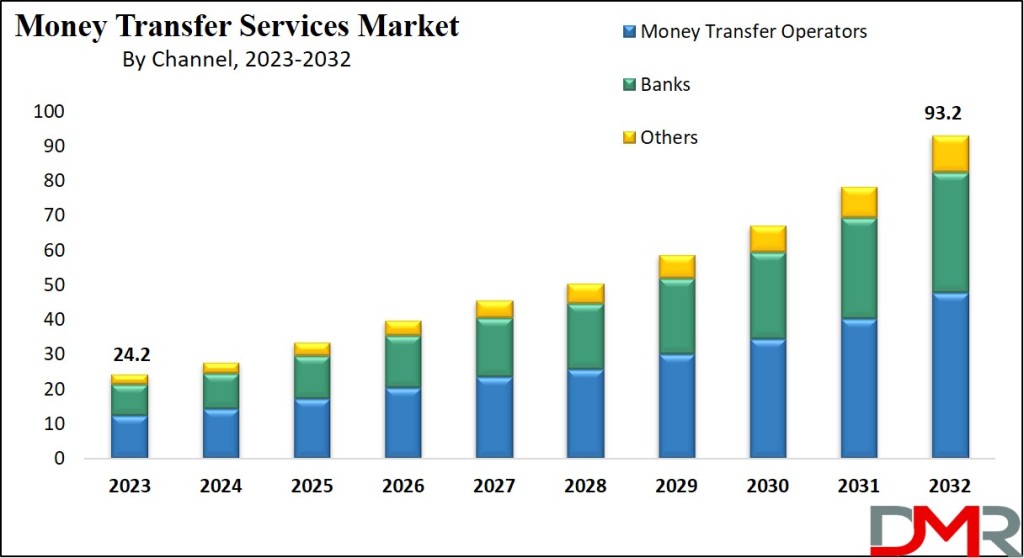

The Money Transfer Services Market has witnessed substantial growth in recent years, and this trend is poised to continue, reaching a value of USD 24.2 billion in 2023. Projections indicate a remarkable surge, with an anticipated market value of USD 93.2 billion by 2032, reflecting a robust Compound Annual Growth Rate (CAGR) of 16.2%. This growth can be attributed to various factors, including the globalization of businesses, increased international migration for work and education, and the subsequent rise in the demand for cross-border money transfers.

Buy This Report Here@ https://dimensionmarketresearch.com/checkout/money-transfer-services-market

Understanding Money Transfer Services

A money transfer service involves the facilitation of funds from a sender to a rightful recipient. These services can encompass local transactions within a single country or extend to cross-border or international transfers connecting two or more nations. With the world becoming more interconnected, the need for efficient and secure money transfer services has become paramount.

Money Transfer Services Market Growth Analysis

The growth in demand for cross-border money transfers is driven by the globalization of businesses and individuals relocating abroad for various reasons. This surge in demand has created a ripple effect, leading to an increased need for reliable and efficient money transfer services, fostering expansion within the industry.

Market Dynamics

Despite the positive trajectory, the global money transfer services market faces challenges. Financial institutions often require rigorous customer identity confirmation before authorizing money transfers. This verification process involves collecting personal details, such as government-issued identification, passports, or utility bills. These protocols are in place to prevent fraudulent activities, ensuring the legitimacy of transferred funds and mitigating the risk of illegal activities.

Research Scope and Analysis

By Type

The outward digital transfer sector emerges as a major driver within the global money transfer services market. This dominance is attributed to individuals residing abroad who send financial aid to their families back home. Financial institutions and banks have played a pivotal role in facilitating secure and quick cross-border money transfers, prioritizing competitive fee structures and broad customer reach.

By Channel

In 2023, the money transfer operators (MTOs) segment maintained its dominance in revenue distribution. MTOs, classified as non-bank financial organizations, focus on delivering comprehensive money transfer solutions, including cash-to-cash transfers, bank transactions, and mobile money transfers. This segment primarily serves individuals lacking access to conventional banking services, such as immigrants and rural residents.

By End User

The personal segment emerges as a major driving force for the growth of the global money transfer services market revenue. This is fueled by the development of new and enhanced products and services, making it easier for individuals to manage their financial accounts. The rising trend of global migration has led to increased adoption of digital payment services by individuals wanting to send money back to their homeland. Additionally, the small businesses segment is anticipated to experience high growth during the forecasted period.

Get a Free Request Sample @ https://dimensionmarketresearch.com/report/money-transfer-services-market/request-sample

Recent Developments (2023-2024) in the Money Transfer Services Market:

1. Continued Rise of Digital Transfers:

- CAGR (compound annual growth rate) projections for online & mobile platforms remain high, reaching up to 16.3% by 2028

- Increased smartphone penetration and adoption of digital wallets are driving this trend, making cross-border transactions easier and faster.

- Examples: Google Pay transactions in the US saw a significant rise from $24.8 billion in 2021 to $65.2 billion in 2022

Key Takeaways:

- Market Growth Trajectory: The Global Money Transfer Services Market is on a robust growth trajectory, set to reach USD 24.2 billion in 2023 and an anticipated USD 93.2 billion by 2032, reflecting a notable CAGR of 16.2%.

- Facilitation of Global Transactions: Money transfer services play a pivotal role in facilitating funds from senders to rightful recipients, spanning local transactions within a country and extending to cross-border or international transfers.

- Market Dynamics: Despite significant growth, the industry faces challenges such as stringent customer identity confirmation requirements by financial institutions to prevent fraud, ensuring the legitimacy of transferred funds.

- Digital Transformation: The integration of digital technologies, including mobile devices and the internet, has streamlined money transfer processes, making them more accessible and contributing significantly to market growth.

Regional Analysis

In 2023, the North American region secured a significant market share, accounting for about 28.8% of the total revenue for the global money transfer services market. Notable financial service and communication firms in the region include Continental Exchange Solutions, Inc., Western Union Holdings, Inc., and MoneyGram. The growing immigrant population in North America is projected to drive the adoption of digital payment services, further boosting the rapid adoption of quick money transfers.

Frequently Asked Questions (FAQs)

1. What factors are driving the growth of the global money transfer services market?

The growth is primarily driven by the globalization of businesses, increased international migration, and the subsequent rise in the demand for cross-border money transfers.

2. What challenges does the global money transfer services market face?

Financial institutions often require rigorous customer identity confirmation, including personal details, to prevent fraudulent activities and ensure the legitimacy of transferred funds.

3. Why is the outward digital transfer sector a major driver in the market?

This sector is driven by individuals residing abroad who send financial aid to their families back home, facilitated by financial institutions and banks offering secure and quick cross-border money transfers.

4. Which segment maintained dominance in revenue distribution in 2023?

The money transfer operators (MTOs) segment, classified as non-bank financial organizations, maintained dominance in revenue distribution in 2023.

5. What region secured a significant market share in 2023?

The North American region secured about 28.8% of the total revenue for the global money transfer services market in 2023.

Conclusion

The global money transfer services market is witnessing substantial growth, driven by factors such as globalization, international migration, and increased demand for cross-border transfers. Despite challenges related to customer identity confirmation, the integration of digital technologies has streamlined the money transfer process. The market is poised for significant expansion, with key players contributing to its dynamic landscape. As the world becomes more interconnected, the role of money transfer services in facilitating global financial transactions is likely to become even more crucial.