Discover postsExplore captivating content and diverse perspectives on our Discover page. Uncover fresh ideas and engage in meaningful conversations

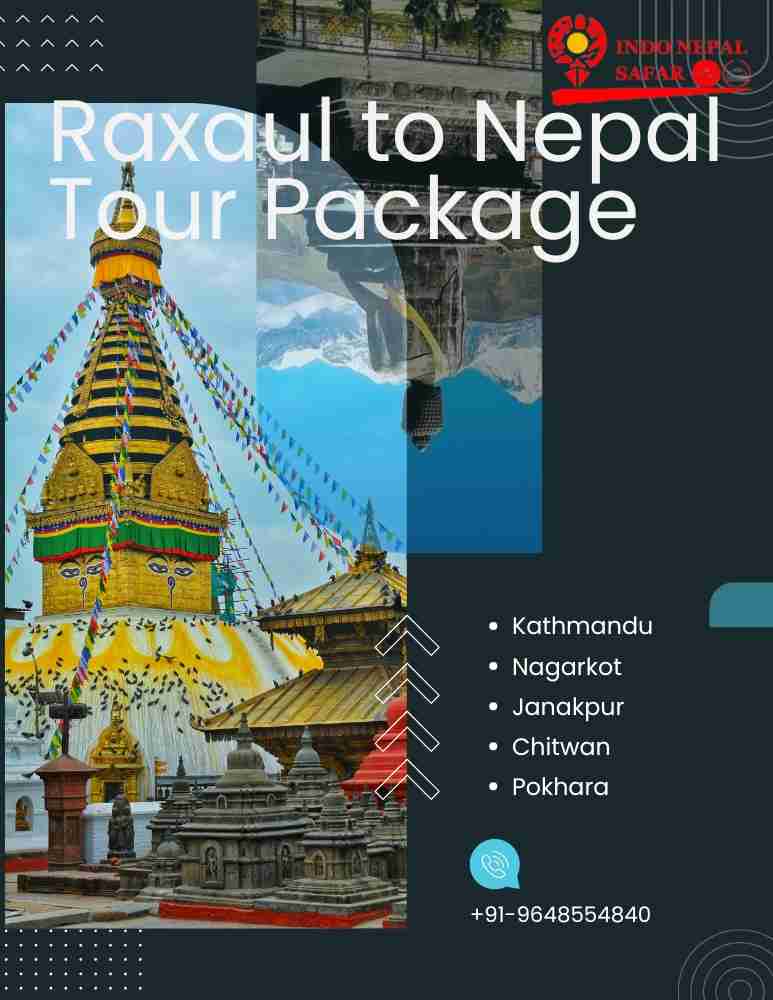

✨ Raxaul to Nepal Tour Package with Indo Nepal Safar ✨

Explore the best of Nepal with affordable and customizable travel packages. Visit Kathmandu, Pokhara, Janakpur & Lumbini, including hotel, cab & sightseeing.

📞 Contact: +91-9648554840

#raxaultonepaltourpackage #nepaltravel #explorenepal #indonepalsafar

Flooring Supplier in Abu Dhabi offers a wide range of premium flooring solutions designed to enhance style, durability, and functionality. From elegant wooden floors to modern vinyl and laminate options, they cater to residential, commercial, and industrial needs. With expert guidance, quality materials, and professional installation, they provide the perfect flooring choices to transform any space beautifully.

For more information visit our website

https://woodenflooring.ae/flooring/

https://maps.app.goo.gl/Nehj3Qb52QjGcdo29

contact us +971566009626

Email : info@rollerblindsshop.com

Buy Verified Bitget Accounts

✉️ Gmail : digitalreviewsshop@gmail.com

☛ Skype: DigitalReviewShop

☛ Telegram: Buy OnlyFans Accounts

☎️ WhatsApp : +1 (512) 588-3591

https://digitalreviewshop.com/....product/buy-verified

#buyverifiedbitgetaccounts #bitgetaccountsforsale #verifiedcryptoaccounts #securebitgetaccounts #bitgetaccountmarketplace #cryptotradingaccounts #buycryptoaccounts #bitgetaccountverification #trustedbitgetaccounts #cryptoinvestmentaccounts

Leading Odoo Partner in UK | Top Odoo Partner - Junari

Junari is a certified Odoo Partner in the UK. We provide the best Odoo development, implementation, and Odoo support services across various sectors.

https://junari.com/

Professional WordPress CMS Development Services

Visit here:

https://webguruz.in/services/wordpress-development

Secure & Affordable Warehouse in Pune for Business Storage | StowNest

Looking for a reliable warehouse in Pune? Stownest offers secure, flexible, and cost-effective business storage solutions with easy access and trusted facilities. Book your space today!

https://stownest.com/business-storage-pune

Revive Your Furniture with Wood Repair & Mid-Century Refinish NYC

In the bustling city of New York, furniture often takes a beating. Whether it’s an accidental scratch, a water stain, or years of wear, your beloved pieces deserve expert care. For anyone searching for reliable wood repair NYC and mid-century modern furniture refinish NYC, Double Queue Restoration is the trusted local specialist that brings quality, precision, and craftsmanship to every project.

https://dqrestorationus.wordpr....ess.com/2025/08/21/r

Website Design Agency in Bangalore

Searching for a Website Design Agency in Bangalore? We specialize in building responsive, search-optimized websites that reflect your brand identity. Our skilled designers ensure a balance of creativity and functionality, giving your business an impactful online presence. Reach your digital goals with our proven solutions. For more details, visit here:- https://www.channelsoftech.com..../best-web-design-com