🎬 Saiyaara (2025) Movie Review: A Melodious Tale of Love, Loss & Redemption

📅 Basic Details

https://www.allyourchoice.co.i....n/news/saiyaara-movi

Release Date: July 18, 2025

Director: Mohit Suri

Production House: Yash Raj Films

Genre: Romantic Musical Drama

Runtime: 2 hours 36 minutes

🌟 Cast & Characters

Ahaan Panday as Krish Kapoor – A passionate, brooding young musician chasing his dreams.

Aneet Padda as Vaani Batra – A gifted lyricist with a mysterious past.

Varun Badola – As Vaani’s supportive and emotional father.

Alam Khan & Shaan Grover – As Krish’s quirky best friends, adding light moments and charm.

📝 Story Summary

Set in the lively cities of Jaipur and Mumbai, Saiyaara tells the story of Krish, a struggling musician hoping to make his mark. His destiny shifts when he finds a diary filled with touching poetry written by Vaani, a quiet and reserved girl with a talent for words.

As their creative collaboration blooms into a romance, an unexpected truth surfaces—Vaani is diagnosed with early-onset Alzheimer’s. Fearing she’ll become a burden, she walks away. Krish, heartbroken, achieves fame alone, only to rediscover her a year later and uncover the real reason behind their painful separation.

Their reunion brings a chance at healing, proving that while memories may fade, love can remain timeless.

🎵 Music: The Emotional Backbone

The music in Saiyaara is more than background—it's the soul of the film. A blend of haunting melodies and emotional lyrics, the songs are beautifully interwoven with the narrative.

Top Tracks:

“Saiyaara – The Title Track”

“Tum Ho Toh”

“Humsafar”

“Tera Mera Pyaar”

Each composition strengthens the emotional tone, capturing the highs and lows of the characters' journeys.

✅ Highlights: What Works Well

🔹 Powerful Debuts

Ahaan Panday and Aneet Padda deliver natural and moving performances that are emotionally resonant and believable.

🔹 Strong Emotional Core

Themes like memory loss, young love, and personal sacrifice are treated with authenticity and grace.

🔹 Breathtaking Visuals

The film showcases stunning visuals of Jaipur’s romantic charm and Mumbai’s isolation, enhancing the emotional tone.

🔹 Mohit Suri's Signature Style

Returning to familiar territory, the director crafts a story soaked in melancholy, melody, and meaning.

❌ Weak Points: Where It Falls Short

🔸 Predictability

The storyline follows a familiar romantic formula, which some viewers may find too safe or expected.

🔸 Pacing Issues

The second half slows down, with certain scenes feeling slightly overstretched.

🔸 Emotional Overload

A few sequences dip into melodrama, which may feel excessive for audiences preferring subtler storytelling.

🎭 Performances Breakdown

Ahaan Panday shows promise with his expressive performance, particularly in scenes of heartbreak and passion.

Aneet Padda stands out with her graceful, restrained portrayal of Vaani, balancing strength and vulnerability.

Varun Badola lends emotional weight, while Alam Khan and Shaan Grover offer comic relief without losing depth.

💬 Reception: What Audiences & Critics Say

Viewers have embraced the emotional storytelling and musical richness of Saiyaara. Critics highlighted the film’s heartfelt execution and fresh performances, even if they noted the narrative’s lack of originality.

The film has been praised for reviving the classic romantic Bollywood vibe while adding a modern emotional twist.

🏆 Final Verdict

⭐ Rating: 4 out of 5

Saiyaara may not reinvent the romantic drama wheel, but it offers an immersive, emotionally stirring experience. For lovers of musical love stories, this film is a soulful ride filled with heart, heartbreak, and healing.

🎯 Who Should Watch Saiyaara?

✅ Recommended if you enjoy:

Deeply emotional romantic stories

Music-driven storytelling

Performances by rising Bollywood talents

❌ Skip it if you:

Prefer fast-paced thrillers or action dramas

Don’t enjoy emotionally heavy, melodramatic plots

Are looking for unpredictable storytelling

🎬 Bollywood Movies Releasing in July–August 2025

https://www.allyourchoice.co.i....n/news/entertainment

The monsoon of 2025 isn’t just bringing rain—it’s raining movies too! From soulful romances and hard-hitting dramas to nail-biting thrillers and mythological blockbusters, Bollywood’s mid-year lineup is ready to electrify the box office. Let’s dive into what’s hitting the big screen this July and August.

🌟 July 2025 Releases

1. Metro… In Dino – July 4

Anurag Basu returns with an urban romantic drama exploring the complexity of modern relationships through an ensemble cast and soulful music.

2. The Hunt – The Rajiv Gandhi Assassination Case – July 4

This intense political thriller reimagines the events surrounding Rajiv Gandhi’s assassination, focusing on the investigation and the national turmoil that followed.

3. Aankhon Ki Gustaakhiyan – July 11

A romantic film inspired by Ruskin Bond’s writing, set amidst scenic hills, evoking emotions of nostalgia and unexpected love.

4. Maalik – July 11

A suspense drama centered on betrayal, greed, and revenge—Maalik promises an edge-of-the-seat experience.

5. Superman (Hindi Dubbed) – July 11

The iconic superhero lands in India with a Hindi-dubbed release packed with international action and heartfelt storytelling.

6. Bas Karo Aunty – July 15

This youth comedy offers laughs and life lessons as it explores start-up struggles and urban chaos through a relatable young protagonist.

7. Saiyaara – July 18

Marking Ahaan Panday’s debut, Saiyaara is a musical love story set in the digital age, full of melody, emotion, and youthful energy.

8. Nikita Roy and the Book of Darkness – July 18

A supernatural thriller starring Sonakshi Sinha, combining folklore, ancient curses, and spine-chilling suspense.

9. Tanvi The Great – July 18

A family drama about hope, courage, and the pursuit of dreams. Expect tears, warmth, and inspiration.

10. Murderbaad – July 18

A small-town romantic thriller filled with dark secrets, obsession, and unexpected turns.

11. Raakh – July 19

John Abraham and Manoj Bajpayee star in this gritty crime drama dealing with justice, vengeance, and redemption.

12. Hari Hara Veera Mallu – July 24

A grand period action-adventure based on Indian folklore, promising epic battles and captivating visuals.

13. Son of Sardaar 2 – July 25

Ajay Devgn returns with a sequel full of action, comedy, and family fun.

14. Param Sundari – July 25

A vibrant romantic comedy that explores modern relationships with humor and heart.

15. Sarzameen – July 25

A patriotic drama rooted in national pride and emotional storytelling, highlighting the sacrifices made for the country.

16. Mandala Murders – July 25

A psychological crime thriller examining the twisted mind of a serial killer and the detectives chasing him.

17. So Long Valley – July 25

A journalist uncovers deep-rooted corruption in a remote valley in this powerful socio-political thriller.

18. The Girlfriend – July 30

Rashmika Mandanna leads this romantic drama about love, betrayal, and healing in a complex urban setting.

🔥 August 2025 Releases

1. Dhadak 2 – August 1

The sequel to the 2018 hit brings a fresh love story with emotional depth and new leads, reviving the charm of the original.

2. Luv Ranjan’s Next – August 1

This untitled dramedy starring Ajay Devgn and Ranbir Kapoor blends humor and relationship chaos in Luv Ranjan’s signature style.

3. Coolie – August 14

Superstar Rajinikanth returns with an action-packed entertainer that blends mass appeal with social themes.

4. War 2 – August 14

Hrithik Roshan, Jr. NTR, and Kiara Advani headline this massive spy thriller sequel, packed with stunts, style, and a global storyline.

5. Bhogi – August 14

A mythological-meets-modern drama exploring faith, destiny, and self-realization through visually rich and symbolic storytelling.

6. The India Story – August 15

This patriotic film traces India’s post-independence journey, celebrating the struggles and resilience of everyday citizens.

7. Wanted 2 – August 15

Salman Khan returns with swagger and action in this sequel that promises high-octane thrills and mass entertainment.

8. Tribanadhari Barbarik – August 22

A mythological epic inspired by ancient warrior tales, with spiritual themes and grand visuals rooted in Indian heritage.

🎯 Final Thoughts

Bollywood’s July–August 2025 lineup is a vibrant blend of everything audiences love—romance, action, emotion, myth, and mystery. As rain pours outside, the silver screen lights up with films that promise laughter, thrills, and unforgettable memories.

🏏 Mahedi Hasan – The Emerging Star of Bangladesh Cricket

https://www.allyourchoice.co.i....n/sports/mahedi-hasa

Mahedi Hasan, a promising all-rounder from Bangladesh, has carved a name for himself with his consistent performances and level-headed approach. Renowned for his intelligent off-spin and ability to contribute crucial runs down the order, Mahedi symbolizes the next generation of versatile cricketers Bangladesh is grooming for the international stage.

👦 Early Life and Passion for Cricket

Born on December 12, 1994, in Khulna, Mahedi grew up surrounded by the passionate cricket culture of Bangladesh. His skills became evident early on, and his determination saw him rise through school and district-level competitions. Recognized for his dual talent as a batter and bowler, he soon made his way into the domestic setup.

🏠 Domestic Cricket Career

Mahedi Hasan’s professional journey began with Khulna Division, where he impressed selectors with his controlled bowling and match awareness. His big break came through the Bangladesh Premier League (BPL), where he represented multiple franchises like:

Barisal Bulls

Comilla Victorians

Dhaka Platoon

His impactful performances in the BPL—economical spells and late-innings cameos—earned him praise and attention from the national team selectors. Additionally, he played a pivotal role for Gazi Group Cricketers in domestic List A and T20 tournaments, showcasing his adaptability and cool-headed performances under pressure.

🌐 International Debut and Milestones

Mahedi Hasan made his T20I debut for Bangladesh on February 18, 2018, against Sri Lanka. His ODI debut followed on March 20, 2021, in a match against New Zealand. Since then, he has been a regular name in Bangladesh’s white-ball squads.

🔑 Notable Performances:

2021 T20I Series vs New Zealand – Proved effective with the ball in low-scoring matches, keeping batters in check.

Asia Cup & T20 World Cups – Selected for his reliability on turning pitches and ability to maintain tight lines in powerplay overs.

Middle-overs Expert – Frequently breaks vital partnerships and controls the tempo of the game.

⚙️ Playing Style and Attributes

Mahedi is known for his flat, accurate off-spin—a style that is particularly useful in T20 formats. His tight bowling during powerplays and his capability to vary pace make him a valuable spinner in limited-overs cricket. As a batter, he plays fearlessly, often adding quick runs at the lower end of the innings.

✅ Key Strengths:

Economical off-spin with variations

Calm under pressure

Capable lower-order striker

Agile and committed fielder

🧠 Temperament and Mental Strength

What makes Mahedi Hasan stand out is his calm demeanor. Whether bowling in high-pressure overs or contributing with the bat during a chase, he remains composed and focused. His game sense allows him to make calculated decisions, making him a dependable all-rounder for Bangladesh.

🔭 Looking Ahead: A Promising Future

Mahedi’s journey is far from over. As Bangladesh aims to build a strong white-ball core, Mahedi is expected to be a central figure in both ODIs and T20Is. His all-round skillset and calm presence make him a potential match-winner in tight situations. With more experience, he could also evolve into a leadership role in the team.

🏁 Conclusion

Mahedi Hasan represents the modern-day cricketer: adaptable, dependable, and focused. From his beginnings in Khulna to making a name on the international stage, he has shown what dedication and discipline can achieve. As Bangladesh eyes greater success in world cricket, Mahedi Hasan is set to play a crucial role in turning those ambitions into reality.

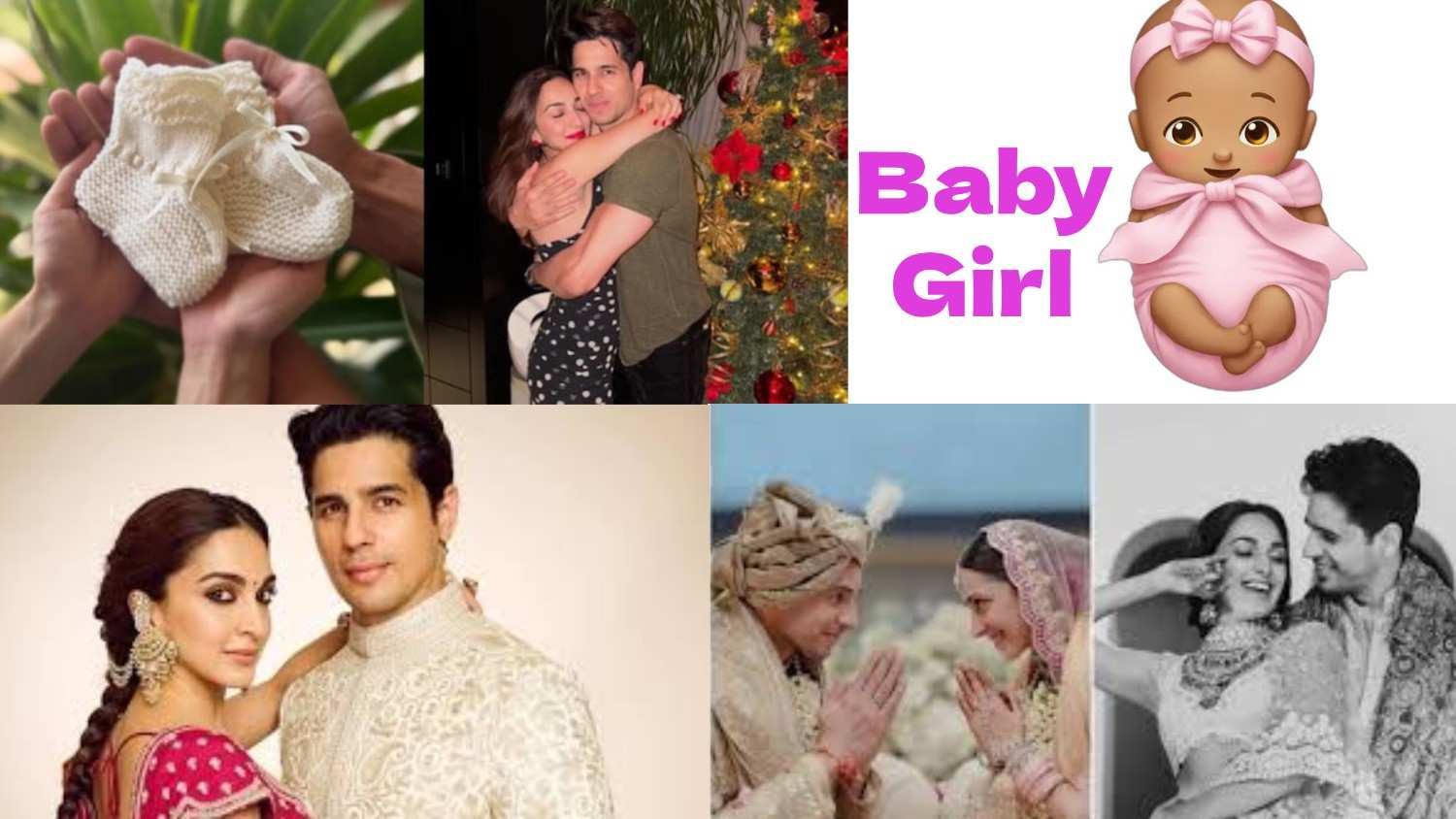

👶✨ Kiara Advani and Sidharth Malhotra are Blessed with a Baby Girl

https://www.allyourchoice.co.i....n/news/kiara-advani-

Bollywood’s much-loved duo, Kiara Advani and Sidharth Malhotra, have been blessed with a baby girl, marking a joyful beginning to their parenthood journey. The news has taken the internet by storm, bringing smiles to their fans and a wave of happiness across the film industry.

🏥 A Precious Arrival: Welcoming Their Little Angel

The baby girl was born at a top hospital in Mumbai, with both mother and daughter reported to be healthy and doing well. Sidharth, standing strong by Kiara’s side, was overwhelmed with emotion as he held his daughter for the first time. The couple is overjoyed and has chosen to enjoy this moment in privacy with their closest family members.

🎬 Real-Life Romance Now a Family Affair

From on-screen co-stars in Shershaah to real-life soulmates, Kiara and Sidharth have always kept their relationship grounded and graceful. Their wedding in 2023 was a fairy-tale affair, and now, with the arrival of their daughter, their love story has come full circle. The couple has entered a beautiful new chapter—as devoted parents beginning a lifetime of love and laughter.

🌟 Love and Blessings Pour In from Bollywood

As soon as the news surfaced, a flood of congratulations began from Bollywood's biggest stars, directors, and producers. While the couple hasn't revealed the baby's name or any pictures yet, close friends have shared that the family is glowing with happiness. Fans have created adorable fan edits and trended hashtags like #babymalhotra, #kiarasidbabygirl, and #bollywoodprincess.

💞 Stepping into Parenthood with Grace

Kiara and Sidharth have always embraced their careers and relationship with balance, and now, they are expected to take some time off to focus on bonding with their daughter. Sources close to the couple reveal they’re fully hands-on and cherishing every moment of their new roles as mom and dad. Their parenting style is likely to reflect their core values—love, humility, and privacy.

💌 A Moment That Touched Millions

This heartwarming news has created a deep emotional resonance with their fans. Many who have followed Kiara and Sidharth’s journey from actors to life partners now feel personally connected to this milestone. Their baby girl is already being called the “little star of Bollywood,” destined to grow up surrounded by love and admiration.

🎀 Wrapping Up with Warm Wishes

The birth of Kiara and Sidharth’s daughter is not just a personal joy—it’s a celebration for their fans and the entire entertainment fraternity. Their beautiful journey continues with a new focus on family, laughter, and little footsteps that will soon echo in their home.

⚽ Fluminense vs Chelsea: A Global Football Spectacle

https://www.allyourchoice.co.i....n/sports/fluminense-

When Fluminense and Chelsea meet on the pitch, it’s more than just a battle between two teams—it's a cultural showdown that blends tradition, style, and ambition. This fixture captures the spirit of international football, bringing together South American creativity and European precision in one thrilling event.

🌎 A Tale of Two Footballing Giants

Fluminense FC, rooted in the heart of Rio de Janeiro, stands as a proud symbol of Brazilian football heritage. Famous for its elegant, free-flowing style and a strong emphasis on technical brilliance, Fluminense continues to shape the legacy of Jogo Bonito—the beautiful game.

Across the Atlantic, Chelsea FC represents the grit and glory of English football. Based in West London, the club has achieved tremendous success over the past two decades, with Premier League titles and a UEFA Champions League triumph to their name. Their style blends strategic discipline with bursts of attacking brilliance.

🔥 What Makes This Match So Special?

1️⃣ Clash of Styles

Fluminense is known for possession play, rhythmic passing, and flair. Players like André orchestrate the midfield with calm and control.

Chelsea brings tactical sharpness, pressing high and striking fast. Enzo Fernández leads their midfield charge with confidence and class.

Expect a match of chess-like precision, spiced with moments of explosive creativity.

2️⃣ Players to Watch

Fluminense: Rising star John Kennedy is dynamic in attack, while veteran leadership in the backline adds balance to their fluid play.

Chelsea: The return of Christopher Nkunku from injury adds unpredictability in the final third, making him a potential game-changer.

3️⃣ Atmosphere and Emotion

Whether it's at the Maracanã or a neutral venue, this match promises a roaring atmosphere. Brazilian drums, English chants, and an ocean of colors—this is football at its most passionate.

🏆 What’s at Stake?

Whether contested as part of a Club World Cup, an international exhibition, or a prestigious friendly, matches like this hold immense value:

Chelsea is out to reinforce its international pedigree.

Fluminense seeks to prove that South America still breeds championship-caliber football.

Beyond silverware, it's a chance for both clubs to connect with global fans and test their mettle on a grand stage.

🎯 Final Whistle

This isn't just about goals and tactics—Fluminense vs Chelsea is a football celebration. It's about identity, pride, and the magic that happens when worlds collide. From the samba soul of Brazil to the structured storm of England, this match reminds us why we love the game.